The IssueS

America’s farmers are getting squeezed from all sides. Crop prices are falling while input costs climb for rural families and agricultural businesses. At the same time, our local power grid is under growing strain as demand rises nationwide, including in the heartland. Meeting this demand requires new energy supply, more skilled workers, and major infrastructure upgrades - and utilities have traditionally passed those costs to ratepayers. The bottom line: farmers, rural communities, and working families are at risk of paying more and more for the power they depend on.

What Can Help?

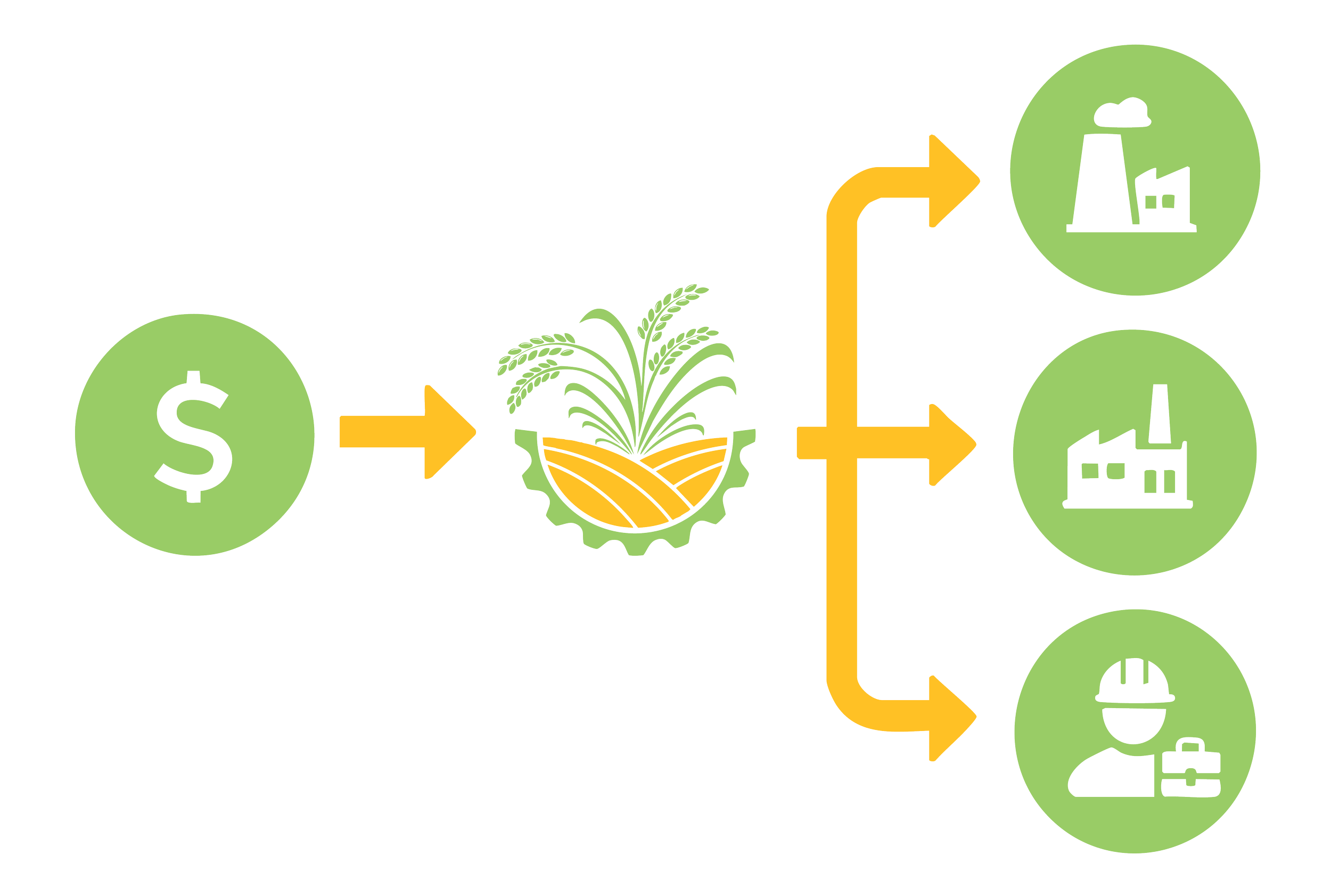

A federal tax credit for biofuels could drive billions in private capital into the Midwest power grid. The rural electric grid stands to gain.

Ever-increasing demand on the power grid – including in America’s heartland – requires more supply, more labor, and critical infrastructure upgrades. To recoup the capital required to generate more energy and expand infrastructure, utilities will usually pass that cost onto consumers. In other words, ratepayers pay for new power plants and upgraded distribution.

State legislatures throughout the country are struggling to battle the energy affordability crisis without ratepayers footing the bill. This is where the Trump Administration and the Congressional Republican majority have stepped in to get the job done.

Thanks to the recently passed H.R. 1, there is now a tax credit (45Z) that could deliver billions of dollars in private capital to the power grid, relieving utilities and ratepayers. Specifically, rural electric co-ops and their farmer-members could see massive private reinvestment from 45Z.

Importantly, because this is private capital being deployed to the power grid, power sector stakeholders can deploy that 45Z capital towards the most crucial needs facing a given Midwest community, such as new power plants of all kinds, more skilled jobs, or efficient infrastructure upgrades.

-

45Z is a tax credit that awards biofuel producers up to $1.00 for every gallon produced. In total, 45Z could create over $6 billion in annual value for the biofuels industry.

Considering that almost 90 percent of biofuel production occurs in the Midwest, the Midwest could see major economic boost from 45Z.

While 45Z is first and foremost a biofuel tax credit, the credit can drive private biofuel capital to make transformational investments into Midwest farms, including small farms, and the Midwest power grid, especially rural electric co-ops.

-

While $1.00 is the maximum per-gallon value of the 45Z tax credit, the actual per-gallon credit value is dependent on various inputs into the fuel production process. For example, the tax credit value will fluctuate based on the type of feedstock procured by the fuel producers. Certain agricultural practices by contracted farmers may also increase the value of the credit.

One of the most important 45Z inputs is electricity. Biofuel producers will enter into specialized 45Z-eligible electricity contracts with the power sector to increase the financial value of their tax credit claims. These electricity contracts are known as energy attribute certificates or “EACs.”

Electricity contracts are of massive value to the biofuels industry. Ethanol Producer Magazine recently called EACs a “profit lever” and a “powerful opportunity.” Farmers for a Fair Deal estimates that electricity contracts alone represent almost $2 billion in annual value for the biofuels industry.

Common sense would suggest then that, considering almost 90% of biofuels are produced in the Midwest, the Midwest power grid should be able to participate in the lion’s share of that near-$2 billion in electricity contract value.

-

While there is the potential for EACs to drive billions of dollars in private capital to the Midwest power grid, that opportunity must be secured by the U.S. Department of the Treasury. 45Z is already law, but the U.S. Department of the Treasury must implement final regulations for the credit. As part of this process, Treasury is currently considering how – and if – those billions in annual electricity value should be allocated.

The straightforward, commonsense approach would suggest that if the Midwest power grid (i.e. parts of the MISO North-Central and SPP grid regions) supports nearly 90 percent of 45Z biofuel production, then the Midwest power grid should participate in the lion’s share of 45Z electricity capital.

Therefore, if Treasury rules that biofuel producers should procure 45Z electricity contracts or EACs from power generators located within the same grid region in which the biofuel is produced, this local reinvestment mechanism would be protected.

However, Treasury is also considering proposals that would reroute that capital to far-flung places like California or – worse yet – simply shut down this opportunity for the Midwest power grid altogether.

-

By simplifying 45Z regulations to ensure that electricity contracts are sourced from the same geographic grid region where 45Z-eligible biofuels are produced, Midwestern biofuel producers would reinvest capital into their own regional economies instead of California’s.

Reinvestment of 45Z capital into the regional power grid will lead to:

Development of more power and expansion of transmission networks, especially for rural grid infrastructure

Expanded and diversified job creation: linemen, skilled trades, construction, and other essential workers

Lower energy costs for ratepayers—especially farmers

Economic growth: new capacity, transmission infrastructure, and jobs support a virtuous cycle of Midwestern economic development, such as advanced technology, agriculture, manufacturing, and even more homegrown fuel production, bolstering heartland industries lifting up rural communities.